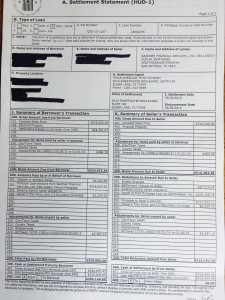

You just closed on your new home Congratulations! If this is your first home, pay special attention. If you have been through a few, you might already know some of what I am about to say. After you’re done celebrating, and before you start stressing about moving in, make sure to do the following: Scan […]